Financials are short for “financials statements.” Financial statements are the written records of a businesses’ daily transactions and activity, such as income and expenses, organized in a clear format.

Financials are important statements in which an accountant or accounting department will generate. These statements allow management to make strategic business decisions.

Common financials:

Profit and Loss Statement

Balance Sheet

The profit and loss statement are one of the most common financials. Other terms people use to refer to this statement include “P&L,” “Income Statement,” “Earnings Report,” “Income and Expense Statement,” “Statement of Operations,” “Statement of Financial Results,” etc…

The profit and loss statement details income and expenses of the company. The very last line is the “net income” also referred to as the “bottom line.”

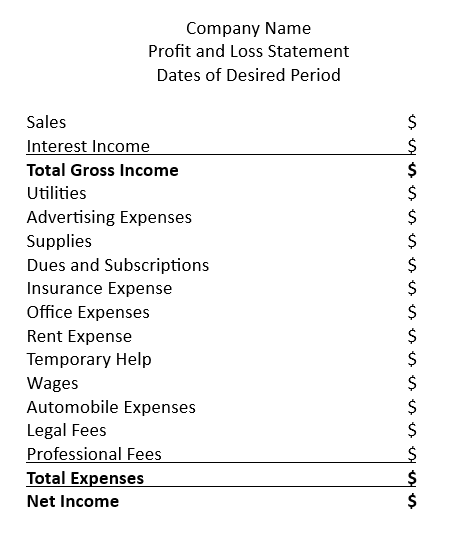

Below is an example of a profit and loss statement that lists the general items you may find. Some companies can get more detailed. For example, depending on the size and complexity of a company, there may be various sources of income that they would like to specify. A clothing company may want to separate online sales vs in store sales. This idea of getting more detailed applies to expenses as well. For example, automobile expenses can be further broken up into “Auto repairs,” “Auto Fuel,” “Parking Fees” etc. The relevancy of these details is determined by the company and what they need to see to make better decisions.

Total Gross Income – Total Expenses = Net Income

You can remember the distinction between net income and gross income by thinking of gross income as “big/large,” and net income as the amount of money left after it “passes through” a net of expenses.

The Balance Sheet shows a company’s assets, liabilities and equity at a certain point in time.

This is an insightful financial statement because it shows the bigger picture of what the worth of one’s company may be, beyond the profit and loss statement. It will reveal the debt a company owes, the assets a company has -both liquid (easily accessible) and non-liquid.

When a company requests to borrow money, this statement will give the lender a better idea of how capable a company is pay back the loan.

The total assets will always equal the total liabilities and equity.

Assets = Liabilities + Equity

Altogether, the financial statements of a company reveal insights on profitability, liquidity and solvency. They help reach actionable insights to make better business decisions and help a business grow.

Need more help or clarification? Contact us and speak to a professional today.