Typically, yes, it yields various benefits for small business owners.

For many small business owners, managing bookkeeping can feel like an overwhelming task. In fact, it’s often reported as one of the most dreaded tasks. Between tracking expenses, reconciling bank statements, managing payroll, and preparing for tax season, the work quickly piles up.

The question naturally arises: is outsourcing bookkeeping a good idea? The answer is often yes.

Here’s why:

What is Outsourced Bookkeeping?

Outsourced bookkeeping is when a business hires a third party professional firm or individual outside of their organization to manage financial record keeping.

Instead of hiring an in-house employee, you gain access to external experts who manage your books remotely with secure accounting software and keeping up with the most up to date regulations.

1. Save Valuable Time

Your time as a business owner is best spent on growth, strategy, and customer service--not paperwork. Every hour you spend balancing books is an hour you’re not focused on sales or building relationships. Outsourcing bookkeeping frees up your schedule so you can focus on what matters most.

2. Gain Accuracy and Expertise

Professional bookkeepers are trained to handle accounts with precision. They stay up to date on the latest regulations, tax codes, and accounting software. This reduces the risk of costly errors and ensures your financial records remain accurate, compliant, and audit-ready.

3. Cut Costs

Hiring a full-time, in-house bookkeeper can be expensive when you factor in salary, benefits, and training. Outsourcing allows you to access high-level expertise at a fraction of the cost, paying only for the services you need.

4. Scale with Your Business

As your business grows, your bookkeeping needs become more complex. An outsourced bookkeeping team can scale their services to match your growth; whether that means handling more transactions, managing multiple accounts, or generating detailed financial reports.

5. Get Better Insights for Decision-Making

Timely and accurate financial reports provide a clear picture of your business’s financial health. With outsourced bookkeeping, you’ll have the data you need to make informed decisions, identify trends, and plan for the future. Your expert should also be able to dive deeper into the numbers for you and pull out the most important insights.

6. Enjoy Peace of Mind

Perhaps one of the biggest benefits is knowing your books are in good hands. This not only reduces stress but also helps you feel more confident about your business’s financial stability.

Frequently Asked Questions About Outsourcing Bookkeeping

Q: Is outsourcing bookkeeping cost-effective?

Yes. You pay only for the services you need, which is often far less expensive than hiring a full-time in-house bookkeeper. The investment will pay off as your books will be audit-ready and gained insights can save you thousands on taxes.

Q: Is outsourcing bookkeeping safe?

Reputable bookkeeping firms use secure software and follow strict confidentiality standards to keep your financial data safe.

Q: How does outsourced bookkeeping work?

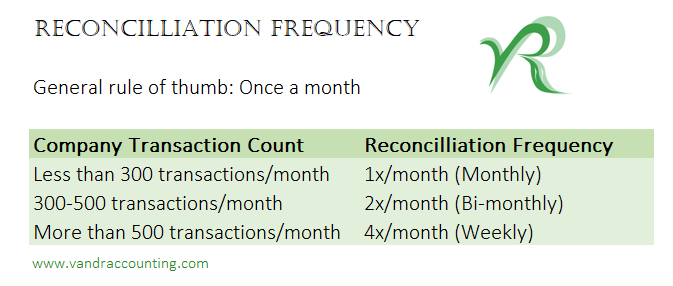

You’ll share your financial data (often through secure cloud software or providing accountant’s access directly through your bank), and your bookkeeper will handle reconciliations, reports, and record-keeping on a regular schedule.

Q: What are the risks of outsourcing bookkeeping?

Choosing the wrong provider can be risky in terms of data security, record keeping accuracy, audit risk, and wasted resources. We recommend always working with a trusted, reputable firm that understands your industry.

Conclusion

Outsourcing bookkeeping is more than just a convenience; it’s a strategic move. It saves time, reduces costs, and provides access to professional expertise, all while helping you focus on running and growing your business. For most small to medium-sized businesses, outsourcing bookkeeping isn’t just a good idea--it’s often the best idea.

Ready to Simplify Your Bookkeeping?

At V&R Associates, we provide professional, reliable bookkeeping services tailored to your business needs. Let us handle the numbers so you can focus on growing your business. Contact us today to get started.