Accounting can be a simple or complex task depending on the size and complexity of a company and the skills of whoever is in charge.

As discussed previously in our blog “Can I do Bookkeeping Myself?”, we uncovered why so many business owners eventually hire a bookkeeper and the benefits it brings.

However, regardless of hiring a bookkeeper or keeping track of your company records yourself, it’s important to know the 4 basic stages of accounting to gather a better idea of the field.

4 Stages of Accounting:

1) Recording Transactions

The step of recording transactions is typically what people refer to as “bookkeeping.” Every transaction that occurs within a company, whether within or out, will be recorded by a company’s bookkeeper. This process is usually done systematically over time in chronological order as the transactions occur. Every single activity that affects the business in any way will be recognized and recorded.

In today’s technological era, everything gets recorded in software as opposed to the ancient way of recording by hand physically. While recording all the transactions, bookkeepers will often utilize the company bank statements, credit card statements, receipts, checks, invoices, assets, and liabilities.

To ensure this process goes smoothly, clear communication is needed between the bookkeeper/accounting department and the company’s management.

2) Classifying Transactions

Classifying transactions involves grouping similar items in designated accounts within the company ledger. A company ledger is the book that all transactions are recorded within each designated account. You may think of the ledger as a book with a table of contents and accounts as the titles within the table of contents. Examples of types of accounts include titles like, “Sales,” “Automobile Expenses,” and “Office Expenses.”

Accountant/bookkeepers may say things like, “Let me know so I can classify it correctly” and “We already booked it.” These phrases are regarding recording and classifying company transactions.

3) Summarizing

Summarizing is the stage of ensuring all the transactions are presented in a way that can be used for the final step of interpretation.

Summarizing occurs after each accounting period. This period is up to the company’s management to decide. It can be monthly, quarterly, bi-annually, or annually. It’s important to remember that a frequency which will best aid decision making should be determined. Companies typically do not choose annual periods since it creates large gaps in decision making and slows company growth.

Financial statements such as an income statement, also called a profit and loss (P&L), balance sheet and cash flow statements are helpful tools that summarize the data. Charts and other supplemental visuals may also be utilized.

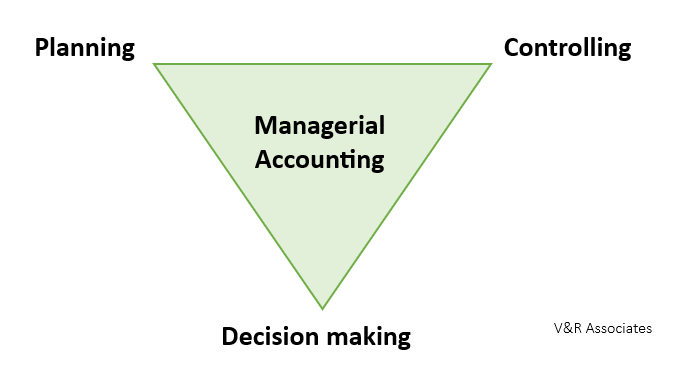

4) Interpreting Financial Data

Interpreting financial data is the crucial step for decision making and creation of company goals.

This step will often utilize an accountant’s expertise and company management to analyze the financial status of the company and plan what can be done to meet goals.

Need help with one or all the stages? Speaking to a skilled professional will help you reach a solution that works best for you. Contact us today to set up a 1:1 consultation.