We understand the do-it-yourself (DIY) mentality -it’s empowering, challenging and is a trait that shows you’re here for the hustle. This trait often makes you stand out and is the reason you have the guts to start and manage your own business.

However, in a competitive city like San Diego, time is your most valuable asset and as a business owner, it’s an element that is constantly running out. When small business owners begin their own company, they often get stuck in the nitty-gritty tasks, piled sky high in receipts, spreadsheets, supplies, orders, you name it. While all elements of a business are important and vital for survival, accounting often gets pushed to the side and can become a daunting task that looms on your shoulders.

If you’re still handling your books while juggling managing and running your own company, it might be costing you more than you think.

We specialize in remote bookkeeping services using QuickBooks online and we’ve seen firsthand the return on investment (ROI) business owners receive once they outsource their bookkeeping/accounting to our hands.

The Damaging Cost of DIY Bookkeeping:

Let’s cut to the chase -bookkeeping isn’t just time-consuming, it’s complex. Accounting is even more advanced. Without a trained licensed and degreed professional, managing your own books could create more damage than good.

Common Errors We See:

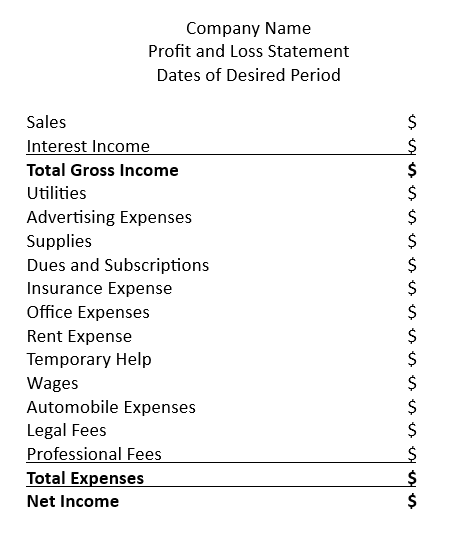

1. Confusion with the basic accounting fundamentals. Most commonly with what belongs on your balance sheet vs profit and loss statement. This is vital for keeping track of your company records, planning for taxes, and preparing your income tax return.

2. Incorrect opening and closing balances. Monthly reconciliation is a must-do task that often people run into issues with. The opening and closing balances must match your bank statements. Without the numbers matching, your books are no longer accurate, complete, or reliable.

3. Failure to capitalize on all business expenses. Not knowing what you can expense really will cost you when you file your income taxes. Working with a professional will allow you to take advantage of strategic tax-saving methods that are rooted in your bookkeeping.

Your time could be better spent on:

1. Client acquisition

2. Developing and perfecting your product or service

3. Brainstorming growth strategies

4. Partnerships

5. Taking your business to the next level

6. Spending time with family

7. Relaxing

The list goes on whether it’s targeted towards your business advancement or personal needs, there are better things in life to focus your energy on.

Let’s quantify it. If your hourly rate is $50 an hour and you’re spending five hours a week on bookkeeping, that’s $1,000 a month on lost opportunity!

If your hourly rate is $100 an hour and you’re spending five hours a week on bookkeeping, that’s $2,000 a month on lost opportunity!

You’re the boss. Pick your hourly rate and do the math. It’s likely the case that professional bookkeeping services would free up your time and be more cost-effective!

What you Gain when Delegating:

Delegating a hired professional is investing in the future.

1. Accuracy

A professional will ensure accuracy and legal compliance with regularly changing rules within the local/state/federal government and IRS. Your books will be ready year-round and prepared in a way that shields you in the case of an audit.

2. Insights

Properly prepared financials and guidance from the right professional(s) will allow you to make vital, informed business decisions to grow and flourish.

3. Scalability

With the proper help, you’re able to expand your business, see a greater bottom line, and have records ready in the case of major expansions, loans, sales, acquisitions and more.

4. Time

When investing in the right help, you gain time. With extra time you can focus on yourself or your business. You can focus on better things in life that bring more meaning to you.

5. Tax Strategy/Savings

Having the proper bookkeeping help allows you to plan for the upcoming tax season with your trusted accountant or tax preparer. Investing in your books will allow you to strategize to potentially save you thousands or more in income tax liability.

6. Audit Protection

Compliant financials will ensure you are up to date with all new regulations and standards. This shields you in the case of an IRS audit to save you thousands in lengthy audit assistance services.

7. Peace of Mind

You no longer need to worry about the finer details in accounting. You can focus on your business and know all is handled properly. Freeing up your mind to focus on more pertinent business matters allows you to accomplish more and grow faster.

The ROI in Real Numbers

Clients that switch to our services report:

· 90-95% of the time they used to think about accounting, now focus on other business matters

· 100% more confidence in business decision making

· 100% more confidence knowing there’s a team to support them for their outsourced accounting needs

These aren’t just numbers, they’re strategic advantages to put you two steps ahead of your competitor.

Ready to Maximize Your ROI Today?

If you’re a San Diego business owner ready to reclaim your time and take your finances seriously, we’re excited to support you in this next chapter of your life.

Our goals are efficiency, transparency, and accuracy to ensure you have the support to grow. Contact us today and one of our friendly team members is looking forward to speaking with you soon!